Bernreuter Research estimates that 100 GW of crystalline solar cells plus 5 GW of thin-film modules produced will translate into 95 to 97 GW of PV installations in 2017.

The newly installed photovoltaic (PV) capacity worldwide will exceed 95GW in 2017, according to the latest forecast of Bernreuter Research. “Supply of the feedstock polysilicon would even allow PV installations to reach 100 GW if inventories were strongly reduced,” says Johannes Bernreuter, head of the market research firm and author of the Polysilicon Market Outlook 2020.

Bernreuter Research expects a global polysilicon output of 460,000 to 465,000 metric tons (MT), including 30,000 MT of electronic-grade material for the semiconductor industry, in 2017. “As sawing solar wafers with diamond wire instead of using slurry is reducing the specific silicon consumption more and more, polysilicon supply will be sufficient to produce 100 GW of crystalline solar cells without overly depleting inventories,” says Bernreuter.

The analyst predicts that the polysilicon spot price will fall from around 16.60 US$/kg currently to a range of 14 to 15 US$/kg by the end of the year when capacities presently under maintenance have returned to operation. Should China, however, impose higher duties on polysilicon imports from South Korea in November; the spot price would be driven up again.

Bottom-up analysis: global installations of 96.5 GW

Taking into account production and shipment time lags as well as inventories in the value chain, Bernreuter Research estimates that 100 GW of crystalline solar cells plus 5 GW of thin-film modules produced will translate into 95 to 97 GW of PV installations in 2017. “Several gigawatts of solar module shipments into the United States will be stockpiled for installation in 2018 to avoid impending tariffs on cell and module imports in the trade case brought up by Suniva and SolarWorld Americas,” explains Bernreuter.

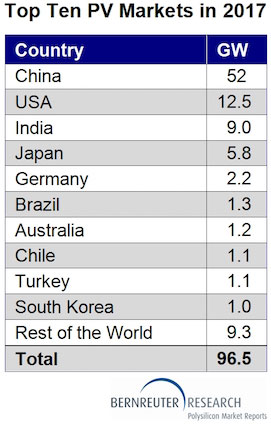

The supply-side analysis of Bernreuter Research is supported by its bottom-up assessment of PV demand in 85 countries, which results in global installations of 96.5 GW in 2017 – up 30% from more than 74 GW in 2016. Another indicator points in the same direction: By extrapolating global demand from the aggregate shipment guidance of the four major module suppliers Jinko, Canadian Solar, JA Solar and Hanwha Q Cells, Bernreuter Research has arrived at a similar result for 2017.

The strong PV growth is mainly propelled by the massive installation boom in China, which no analyst anticipated at the beginning of this year. After 42 GW were already connected to the grid in the first three quarters, Bernreuter Research expects that new PV installations in China will exceed 50 GW in 2017 (see table).

It is India that has already been feeling a negative effect of the rampant Chinese demand: High module prices and canceled module shipments from China, among other factors, have slowed down the momentum of installations on the subcontinent since the middle of the year. Nevertheless, with 9 GW, India will rise to number three behind the USA (12.5 GW). It will leave behind Japan, where PV installations will drop from 7.9 GW in 2016 to below 6 GW this year.

For more information, please go to www.bernreuter.com, or follow Bernreuter Research on LinkedIn.