Declining for the ninth straight quarter, passenger vehicle sales in India plunged 78.43 per cent in the April-June period this year hit by the coronavirus pandemic, making it the longest slowdown in 20 years, auto industry body SIAM said on Tuesday.

SIAM said Auto Industry Decline by 75% During the 1st Quarter of 2020-21 Compared to Same Period Last Year Significant Improvement in June 2020 for Passenger Vehicle and Two Wheelers Compared to Previous Months

The commercial vehicles segment also saw a decline of 84.81 per cent in sales during the period, the fifth quarter in succession of decline, which is also the longest period of slowdown the segment has witnessed in the last 15 years, according to the latest data by the Society of Indian Automobile Manufacturers (SIAM).

Passenger vehicle (PV) sales were at 1,53,734 units in April-June 2020 as compared to 7,12,684 units in April-June 2019.

In the past 20 years, the previous longest streak of decline of five quarters in PV sales was witnessed between 2013-14 and 2014-15 and between 2000-01 and 2001-02.

Similarly, commercial vehicles sales stood at 31,636 units in the period as against 2,08,310 units in April-June 2019. The previous longest period of decline in CV was witnessed for eight quarters between 2013-14 and 2014-15, SIAM said.

“Currently, we are going through a very difficult phase due to coronavirus… We have been suffering hugely on the demand side since last year; but this quarter, the degrowth is due to COVID-19. It is going to be very harsh on the auto sector,” SIAM President Rajan Wadhera told reporters in a video conference.

He said the outlook for the auto sector looks grim due to decline in sales expected to range in 26-45 per cent across various vehicle segments of the industry, and forecast of lower GDP growth coming from various quarters including the RBI Governor and ministers of the government.

“Therefore, there is a need for a strong stimulus from the government for the sector as was done in the past when the sector was hit by slowdown,” Wadhera said.

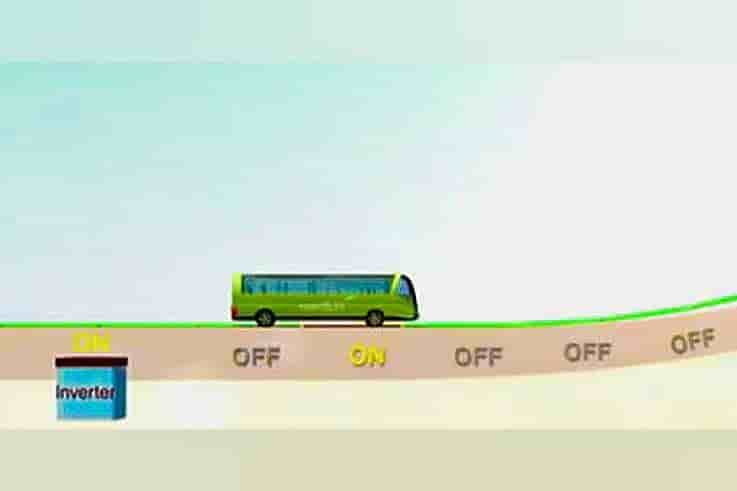

He reiterated the auto industry’s long-pending demand for 10 per cent reduction in goods and services tax (GST) across all vehicle categories and introduction of incentive-based scrappage scheme to generate demand.

“The incentive for the scrappage scheme could be generated in the form of 50 per cent rebate in GST, road tax and registration charges,” Wadhera said, adding the auto industry with an expected profitability of just around 3-9 per cent is not in a position to offer discounts anymore for scrappage incentive.

SIAM said, during the quarter, two-wheeler sales were at 12,93,113 units as compared to 50,13,067 units in April-June 2019, down by 74.21 per cent. Similarly, three-wheeler sales were 12,760 units as against 1,49,797 units in the year-ago period, a decline of 91.48 per cent, SIAM said.

Wadhera said SIAM members have resumed production, but it has not been smooth due to supply chain issues owing to the health crisis due to continued restrictions in some places where supplier factories are located, non-availability of labour and delays in clearing of import consignments, besides COVID-19 cases emerging in and around production sites of some member companies.

He also said, henceforth, SIAM – which has been releasing monthly sales data across all vehicle categories – will be doing it only for passenger vehicles, two-wheelers and three-wheelers as commercial vehicle (CV) manufacturers have expressed their discomfort in sharing monthly sales data.

CV sales data will be shared on a quarterly basis along with grand total of all categories, Wadhera added.

In June, passenger vehicle sales in India declined by 49.59 per cent in June at 1,05,617 units as against 2,09,522 units in the same month last year, SIAM said.

During the month, market leader Maruti Suzuki India sold 51,274 units, down 49.61 per cent from the same month last year. Hyundai Motor India posted sales of 21,320 units, a decline of 49.25 per cent and Mahindra & Mahindra sold 8,075 units, down 54.54 per cent.

Two-wheeler sales were also down 38.56 per cent at 10,13,431 units as compared to 16,49,475 units in the same month last year. Motorcycle sales were at 7,02,970 units as against 10,84,596 units in June 2019, down 35.19 per cent.

Scooter sales were also down 47.37 per cent at 2,69,811 units as against 512,626 units in the same month last year.