Orb Energy, a vertically integrated solar energy solutions provider, has achieved a major milestone by disbursing over ₹300 crore through its zero collateral, zero down payment financing facility.

This innovative approach addresses a critical barrier for Indian SMEs and MSMEs, making solar energy adoption more accessible and cost-effective.

Empowering SMEs with Accessible Solar Solutions

Orb Energy’s unique financing model allows businesses to repay loans over five years without the need for collateral or upfront payments. Once repaid, clients benefit from decades of free electricity, supported by solar panels with a 25-year warranty.

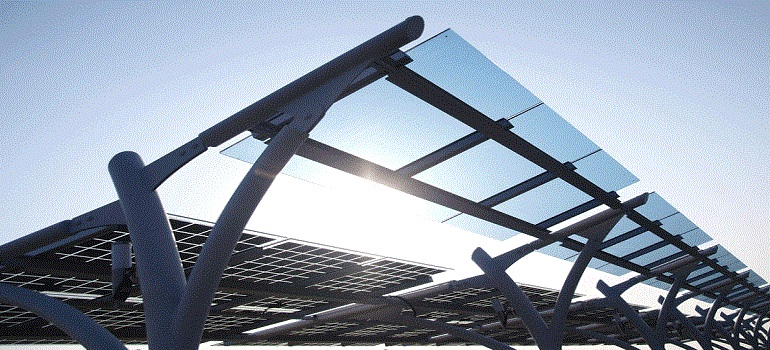

By eliminating high upfront costs, Orb Energy has made significant progress in transitioning small and medium enterprises to solar energy. To date, the company has deployed approximately 350 MW of solar PV installations, with a strong presence in southern and western India.

Driving Growth and Sustainability

Damian Miller, Co-founder and CEO of Orb Energy, emphasized the company’s mission:

“Financing has been a major challenge for SMEs in adopting solar energy. Our tailored solutions remove this barrier, enabling businesses to reduce costs, enhance profitability, and transition to sustainable energy. The long-term savings from lower electricity expenses significantly boost their competitiveness.”

Future Plans and Renewable Energy Goals

Building on this success, Orb Energy plans to disburse an additional ₹1,000 crore in financing over the next three years. This initiative aims to further support Indian businesses in reducing operational costs and contributing to the country’s renewable energy targets.

Orb Energy’s full-stack solutions, from manufacturing to financing and installation, solidify its position as a pioneer in India’s solar energy landscape, empowering businesses to embrace sustainability and achieve long-term value.