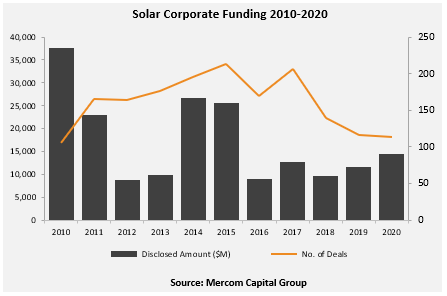

Total corporate funding into the solar sector globally, including venture capital and private equity (VC), debt financing, and public market financing, came to $14.5 billion, a 24% increase compared to the $11.7 billion in 2019 says Mercom Capital in its annual report.

“Following a tough first half when corporate funding was down 25% year-over-year, recovery has been swift and broad, with corporate funding up 24% for the year. Publicly-traded solar companies had an unprecedented year. The solar ETF was up 225%, with 15 solar stocks up over 100% in 2020. Public market funding was also up with the help of several IPOs, and debt financing was up on the back of securitization deals. Solar asset acquisitions were at an all-time high in a pandemic year and have become even more sought-after as an investment haven, especially in the uncertain COVID economy,” said Raj Prabhu, CEO of Mercom Capital Group.

Global VC funding in the solar sector in 2020 came to $1.2 billion in 41 deals, compared to $1.4 billion in 53 deals in 2019.

Of the $1.2 billion in VC funding raised in 41 deals in 2020, $1.1 billion went to 27 Solar Downstream companies, $61 million for Solar Service Providers, $17 million for PV companies, $15 million for Balance of System (BOS) companies, $15 million for Thin Film Technology companies, and $5.5 million for Concentrator photovoltaics (CPV) companies.

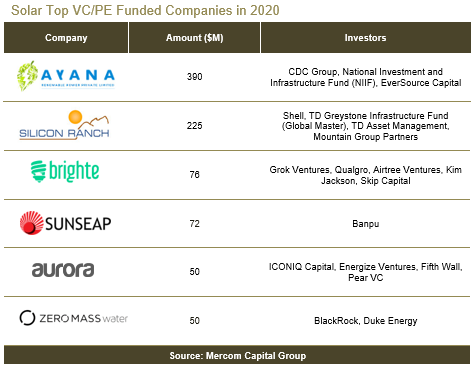

The top VC funded companies in 2020 were Ayana Renewable Power with $390 million, Silicon Ranch Corporation with $225 million, Brighte with $76 million, Sunseap Group with $72 million, and Aurora Solar and Zero Mass Water with $50 million each.

There were 102 VC and PE investors that participated in funding deals in 2020.

Public market financing was up 101% with $5.1 billion in 2020.

In 2020, announced debt financing came to $8.3 billion. Eight securitization deals totaling $2.2 billion were recorded in 2020, the largest amount in a year.

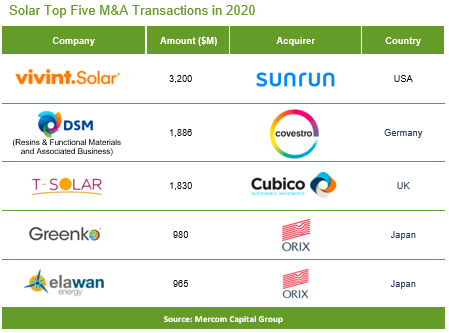

62 Merger and Acquisition (M&A) deals were transacted in the solar sector in 2020 compared to 65 in 2019. Most of the transactions involved Solar Downstream companies.

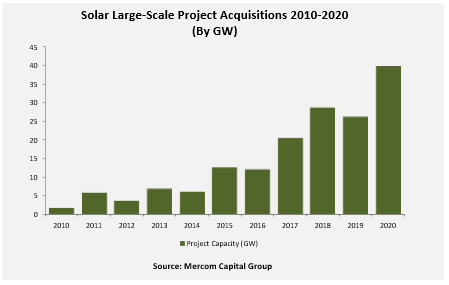

There were 231 large-scale solar project acquisitions in 2020 compared to 192 transactions in 2019.

The report stated that a record 39.5 GW of large-scale solar projects changed hands in 2020 compared to 26.1 GW in 2019. This was the largest amount of projects acquired in a single year to date.

To learn more about Mercom’s 2020 Solar Funding and M&A Report click here.

Climate Samurai Members support independent journalism at a time when trusted storytelling, climate awareness and community engagement is more important than ever. We have small but strong editorial team that brings you uninfluenced and curated news that you can trust. To support truly independent journalism, please consider taking a subscription which is free like our thought.