Company secures long-term funding, strengthens financial health, and boosts clean energy efforts.

Avaada Energy, a leading renewable energy company in India, announced the successful completion of a significant refinancing deal, solidifying its position in the country’s clean energy sector. The company secured approximately INR 4,471 crore (USD 535 million) from the National Bank for Financing Infrastructure and Development (NaBFID).

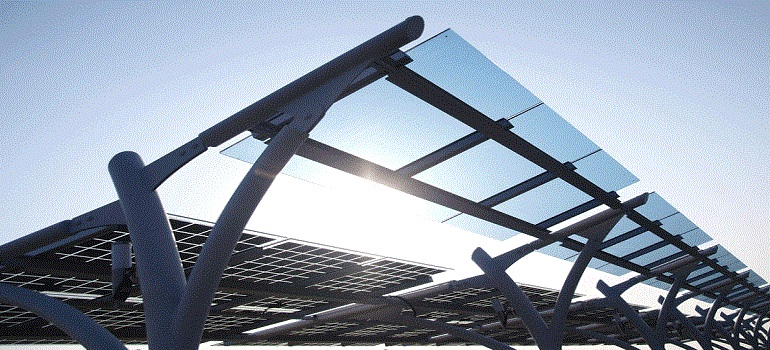

This transaction, touted as one of the largest refinancing deals in India’s renewable energy space, involves four interconnected solar projects with a combined capacity of 1700 MWp situated in Rajasthan. The refinancing structure, categorized as “Restricted Group,” has received a stable rating of “AA” by CareEdge Ratings.

Avaada highlighted this accomplishment as a critical step towards achieving a sustainable future. The refinancing ensures stable cash flow over the long term and strengthens the company’s financial health. This will significantly contribute to India’s renewable energy generation efforts and empower Avaada to make a more substantial impact on global carbon footprint reduction.

The financing provided by NaBFID, a government-backed development institution, facilitated the prepayment of existing loans, allowing multiple lenders to exit their positions successfully. The 20-year rupee term loan offered by NaBFID boasts improved commercial terms compared to the previous facilities.

Commenting on this achievement, Vineet Mittal, Chairman of Avaada Group, said, “We are proud to have achieved this major milestone by refinancing four of our largest operational solar assets in Rajasthan, which have been functioning for nearly two years. This transaction ranks among the biggest in India’s renewable energy market and enables us to settle dues with existing lenders while welcoming NaBFID as our sole financing partner. This development underscores the growing interest of financial institutions in supporting dependable renewable energy projects that generate stable, long-term cash flow. Securing a more favorable interest rate for operational assets further strengthens our financial standing while delivering value to all stakeholders.”