Historical Development

India has had an active involvement with wind power since the earliest days of the technology’s development and continues to play a major role as one of the world’s biggest markets. Wind power in the 1980s was characterised by a number of demonstration projects consisting of turbines in the 40 kW to 55 kW range, a number of which were installed by the Indian Government with Danish aid. These demonstration wind farms gave the electricity boards and general public an idea of the technical aspects of big wind power installations.

In 1989, Denmark set the tone for large-scale deployment of wind turbines in India. Under a program funded by the Danish development agency 20 MW of wind power equipment was made available to the Indian Government. It was decided that 10 MW would be deployed at Lamba in Gujarat and 10 MW in Tamil Nadu. Simultaneously, a World Bank credit line with low interest rates became available through IREDA.

In the late 1990s, development slowed down significantly, predominantly due to the World Bank credit line exhausting and the high interest-rate environment deterring potential investors.

In 2000, installation rates of wind turbines started to increase once again. This time there was a better understanding of the technology by investors. Madhya Pradesh, although not a front runner in wind turbine deployment, introduced some innovative schemes to attract investment, most notably the sales tax write‑off that enhanced the commercial viability of wind turbine deployment. Maharashtra also introduced a similar scheme and simultaneously provided significant help in terms of infrastructure development. It is interesting to note that Tamil Nadu was the only state with stable policies for over two decades resulting in the state repeatedly achieving the highest number of wind power installations. Maharashtra, with its progressive approach, has also seen capacity expand steadily in recent years. Karnataka followed suit because it had some of the best resource in the country, although developments were somewhat complicated due to unpredictable policy shifts in initial years.

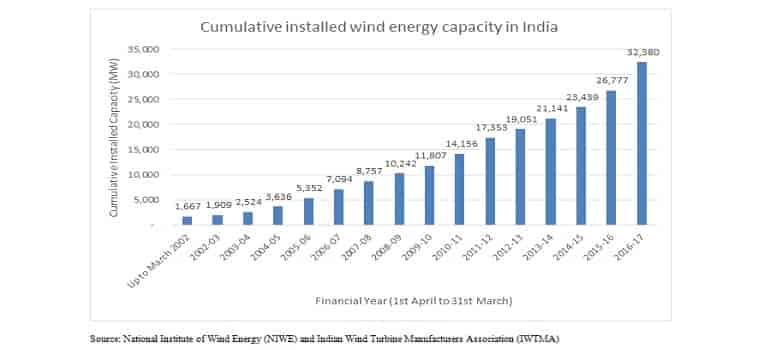

Policies of key states were stable for several years, and tariffs for wind power improved before the introduction of reverse auction model. With cumulative installed wind power generation capacity of 32.7 GW by end of September 2017, India is the fourth-largest wind power producer in the world, after China, USA and Germany. India achieved the largest-ever wind power capacity addition of 5.5 GW in 2016-17, exceeding the target by 37 per cent. The cumulative installed capacity for India, since 2002, is shown below:

Market Drivers and Qualifiers

In many ways it can be argued that the expansion in India’s installed wind capacity can be traced back to two major drivers: the lack of electricity generation capacity, combined with structural bottlenecks that favoured distributed sources of electricity generation[1], and the implementation of favourable incentives by the Indian Government, namely the accelerated depreciation (AD) scheme. This original scheme were followed by other government policies such as the Generation Based Incentives (GBI), the Renewable Purchase Obligation (RPO), preferential tariffs, the Renewable Energy Certificates (REC) and other financial support structures that include concessional custom duty on specified items, excise duty exemption, sales tax exemption, income tax exemption for 10 years, etc.

Accelerated Depreciation benefit was first introduced in 1994 with a depreciation rate of 100 per cent which was subsequently reduced to 80% in 2002. This benefit provided the required financial incentive to attract private sector investment in the wind sector, and facilitated the entry of high net worth individuals, corporations, and small and medium sized enterprises. These investors have harnessed wind energy to meet their captive demand and used it as an instrument to offset the profits from their other businesses. Though the AD scheme supported the creation of a large renewable capacity base in the country, it was perceived to be lacking in focus on long term generation efficiencies as incentive was linked to the capital cost of the project with no provision to link the benefit with the performance. The other drawback of the policy was its limitation for large independent power producers and foreign investors since the tax depreciation benefit could only be availed by entities with profits in the parent business and profits within

India. To address these limitations, GBI scheme was introduced in 2010 as an alternative to the AD scheme. Under this scheme, an incentive of INR0.50 per unit of electricity fed into the grid was provided over and above the state-fixed tariff for a period of no less than four years and a maximum period of 10 years.

The sharp reduction in AD and the removal of the GBI in April 2012 caused a significant slowdown in activity prompting the government to retroactively restore the GBI and in August 2014 the AD benefit for the wind sector was reinstated at the previous rate of 80 per cent for plants installed on or after April 1, 2014.

The increasing focus on efficient generation rather than capacity, which was one consequence of the AD incentive, led to more rigorous pre-construction energy assessments and better operational monitoring. This was achieved through improved Operation &Maintenance and short-term power forecasting – areas where practices in India were historically less rigorous than international norms. Concentrating on these keys areas will help reduce the risk to investors. Other aspects gaining attention include investments in better wind monitoring procedures (covering equipment and mast set-up, data maintenance and selection of measurement locations), and an increased focus on turbine reliability and turbine operation monitoring (SCADA) software. It can be argued, therefore, that these changes are driving the sector to long-term maturity and operational reliability.

Opportunities and Challenges:

Wind energy has been the mainstay of the renewable sources in India constituting 55% of the grid interactive renewable energy as on 30 September 2017. Successive Government at the centre and states have generally promoted renewable energy. There is social acceptability too for wind energy as there has been no major resistance or NIMBY effect (not in my Back Yard effect) that are sometime witnessed in Europe or US. However, both opportunities and challenges lay ahead for the wind energy in India that are described below:

Onshore Wind Resource Potential

National Institute of Wind Energy (NIWE, erstwhile C-WET), an autonomous R&D institution under the Ministry of New and Renewable Energy (MNRE), Government of India, had first estimated the potential wind energy capacity in India to be approximately 49.1 GW at 50m based on their mesoscale Indian Wind Atlas, combined with the results from measurement campaigns (where available) across the country. Under National Wind Resource Assessment programme, MNRE through NIWE and State Nodal Agencies installed and monitored 794 dedicated Wind Monitoring Stations (WMS) of height ranging from 20 m to 120 m (20m, 25m, 50m, 80m, 100m & 120m) throughout the country. Based on the measurement campaign, the potential for wind power generation for grid interaction has been estimated at about 102.8 GW taking sites having wind power density greater than 200 W/sq. m at 80 m hub-height with 2% land availability in potential areas for setting up wind farms. The potential considering 100m hub height has been estimated as 302 GW.

Table 2: Estimated wind power potential and current installed capacities for different Indian States at 50m, 80m and 100m

| States

& Union Territories |

Estimated Potential [MW] | Installed Capacity [MW] | ||

| 50m | 80m | 100m | March 2017 | |

| Gujarat | 10,609 | 35,071 | 84,431 | 5,429 |

| Andhra Pradesh | 5,394 | 14,497 | 44,229 | 3,611 |

| Tamil Nadu | 5,374 | 14,152 | 33,800 | 7,870 |

| Karnataka | 8,591 | 13,593 | 55,857 | 3,775 |

| Maharashtra | 5,439 | 5,961 | 45,394 | 4,752 |

| Rajasthan | 5,005 | 5,050 | 18,770 | 4,280 |

| Madhya Pradesh | 920 | 2,931 | 10,484 | 2,498 |

| Kerala | 790 | 837 | 1,700 | 60 |

| Telangana | 4,244 | 101 | ||

| Others | 7.008 | 10,696 | 3342 | 4 |

| Total | 49,130 | 102,788 | 302,251 | 32,380 |

Sources: NIWE & IWTMA

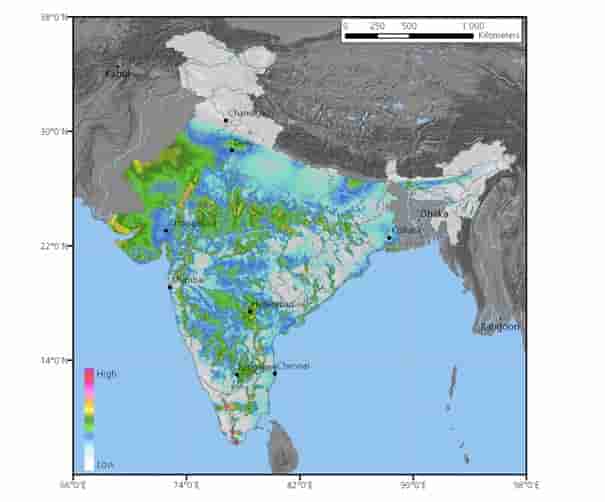

DNV GL has undertaken its own mesoscale modelling of the whole of India in order to produce a map of the onshore wind resource as presented in figure below:

Figure 1: DNV GL Wind speed map of India at 80m height

Source: DNV GL

The wind map highlights that the areas of greatest potential lie in the south and west of the country. These include areas which have already attracted the greatest activity and interest such as the Ghats of western Tamil Nadu, south western Andhra Pradesh and central Karnataka; along the Western Ghats of Karnataka and Maharashtra, the Gulf of Kachchh in Gujarat and in the Thar Desert of Rajasthan.

However further areas of high wind speed potential can be identified where activity to date has been far below potential. These include the Palghat Gap in Kerala, the mountains of central and central-south Andhra Pradesh, the highland areas of eastern Madhya Pradesh and the Aravalli Range in Rajasthan.

The reasons for such uneven development across areas of higher wind speed are varied and include;

- wind monitoring programs being taken up in different stages resulting in staggered activity around the country;

- Variations in state policies and support to the wind industry;

- environmental concerns regarding construction in ecologically sensitive areas (such as in Kerala and parts of Rajasthan);

- Areas overlapping mining regions with land under the control of mining lease holders (parts of Rajasthan and Karnataka);

- Complex terrain creating access and construction problems (such as in Aravalli range in Rajasthan);

New Renewable Target and Focus on Solar

In 2015, The Government up-scaled the target of renewable energy capacity to 175 GW by the year 2022 which includes 100 GW from solar, 60 GW from wind, 10 GW from bio-power and 5 GW from small hydro-power. Indian Government has ratified the Paris Climate Agreement with a commitment to achieve 40% cumulative electric power capacity from non-fossil fuel based energy resources by 2030.

The target set by MNRE for wind for various states are tabulated below.

| States

& Union Territories |

Estimated Potential [MW] | Installed Capacity [MW] | Target

(source: MNRE) |

||

| 100m | March 2017 | By 2022 | |||

| Gujarat | 84,431 | 5,429 | 8,800 | ||

| Andhra Pradesh (AP) | 44,229 | 3,611 | 8,100 | ||

| Tamil Nadu | 33,800 | 7,870 | 11,900 | ||

| Karnataka | 55,857 | 3,775 | 6,200 | ||

| Maharashtra | 45,394 | 4,752 | 7,600 | ||

| Rajasthan | 18,770 | 4,280 | 8,600 | ||

| Madhya Pradesh | 10,484 | 2,498 | 6,200 | ||

| Kerala | 1,700 | 60 | |||

| Telangana | 4,244 | 101 | 2,000 | ||

| Others | 3,342 | 4 | 600 | ||

| Total | 302,251 | 32,380 | 60,000 | ||

Source: MNRE & IWTMA

As can be seen in the above table, Andhra Pradesh, Telangana and Madhya Pradesh are expected to have high proportional increase in the wind installation by 2022. The achievement and target set by MNRE for wind and solar for the three financial years are as below:

| Source | Target

(2015-16) |

Achievement

(2015-16) (MW) |

Target (2016-17)

(MW) |

Achievement

(MW) |

Target (2017-18)

(MW) |

Achievement (April- September 2017) | Target 2018-19

(MW) |

| Wind | 2,400 | 3,423 | 4,000 | 5,400 | 4,600 | 421 | 5,200 |

| Solar | 1,400 | 3,019 | 12,000 | 5,526 | 15,000 | 2,483 | 16,000 |

Source: MNRE, January 2017

Though target looks very ambitious but the focus of current government on renewables has led to largest ever wind and solar power capacity addition of 3.4 GW and 3.0 GW respectively in 2015-16 and 5.5GW each for wind and solar in 2016-17. The cumulative solar installation has increased from 2.6 GW t0 12.2 GW in the last 3 financial years and is expected to surpass cumulative wind installation before 2022.

The high cost of financing in India in recent years has affected development of wind and indeed all forms of power generation. Investors with access to longer-term lower-cost capital may hold an advantage facilitating development of sites beyond the reach of players facing higher capital costs. Besides, solar will also now compete with the wind projects for the viability and share of investment.

Availability of land for development has traditionally created challenges for wind sector development in India and the problem will be further compounded with the solar competing primarily in the region rich in wind resource.

Grid Stability

The variability of wind-power generation has led to some concerns regarding the technical capabilities of the grid system to manage increasing levels of wind in the power generation mix. However, the capacity and penetration levels of wind energy are still significantly lower than that of some other networks with high levels of wind energy, such as Ireland and the Iberian Peninsula (both of which are also largely isolated systems). This suggests that with adequate upgrades to the country’s internal grid network and use of suitable modern turbines, there are no absolute technical reasons why additional wind energy capacity could not be comfortably accommodated.

However, transmission and distribution infrastructure within India requires significant investment to allow this scenario to occur. Massive ramp in grid infrastructure is also necessitated if India is to meet its target of 175 GW by 2022. Indeed, wind farms in Tamil Nadu and Maharashtra, two leading states for wind energy deployment, and Rajasthan in recent past are subject to curtailment. Challenges posed by these constraints as well as grid fluctuations could provoke changes in wind farm and wind turbine design to accommodate variable grid conditions, for example through turbines with low-voltage ride-through (LVRT) capabilities. It should be noted that Central Electricity Authority (CEA) has made LVRT feature mandatory amending the technical standards for connectivity to the grid. Central Electricity Regulatory Commission (CERC) has also passed order for all the WTGs to comply with LVRT requirements. As per the order, all new turbine models are required to have certificate of compliance from third party agency with a provision of type test as part of turbine test certification from accredited certification bodies while existing turbine models are required to comply with the requirements by 4th January 2018. There has been resistance in the industry due to the cost implication for retrofitting and other technical challenges and it is unlikely that this target will be fully met by this date. However, Indian regulators have been consistent in pushing for the requirements given the current vulnerability of grid stability.

In the longer term, there are other numerous technical options to facilitate much greater amounts of wind power – such as improved interconnection within India and with other countrie, short-term forecasting.

and intelligent management of supply and demand through a ‘smart grid’. Indeed, short-term forecasting is already a well-established service and in India it is typically possible to achieve day-ahead forecast with reasonable accuracy. Indian regulators have made considerable efforts to enforce short term forecasting.

The Renewable Regulatory Fund (RRF) Mechanism was notified by CERC in April 2010 as part of the Indian Electricity Grid Code, and was the first regulation through which efforts were made to introduce mandatory forecasting, scheduling and commercial settlement for deviations of the wind and solar power generators. This regulation was applicable to wind generators having a capacity greater than 10 MW and solar generators having a capacity greater than 5 MW being connected to the intra-state or inter-state transmission network at a voltage equal or greater than 33 kV. However, the implementation of RRF faced numerous difficulties and the issue was taken to the Court that stayed the commercial settlement part of the regulation but continued forecasting and scheduling of wind generation. Based on these experiences, CERC came up in August 2015 with the Framework on Forecasting, Scheduling and Imbalance Handling for Wind and Solar Generators Connected to Inter State Transmission System as a substitute to previous RRF Mechanism. For Intra State Transmission System where most of the wind projects are connected, Forum of Regulators (FoR) came up with similar framework for forecasting and scheduling of wind and solar generators connected to the state grid. Based on this, Indian States are now coming up with similar regulations.

Further, for better grid integration of renewables, Renewable Energy Management Centers (REMCs) are proposed to be established at each Dispatch Centre at State, Regional and National Level. The REMCs at the state and regional levels are proposed to be responsible for the forecasting and scheduling of renewable generation in its respective area. Power Grid Corporation of India Ltd. (PGCIL) is currently in the process of establishing the REMCs at the southern and western regions.

Grid Infrastructure

Wind projects in India have had a major challenge in terms of poor grid infrastructure that has led to grid curtailment in Tamil Nadu, Maharashtra and recently in Rajasthan. The target of 175 GW by 2022 would be practically impossible with current infrastructure and would require massive ramp up.

To facilitate integration of large scale renewable generation capacity addition, a comprehensive scheme including Intra-State and Inter-State transmission system was identified in 2013 as a part of ‘Green Energy Corridors’. Under this scheme, Intra-State Transmission System is being implemented by respective State Transmission Utilities (STU) and Inter-State Transmission System is being implemented by PGCIL The funding for both intra and inter State transmission projects, under the framework of cooperation between Govt. of India and Govt. of Germany, is primarily being provided by KfW Germany as a soft loan to the tune of Euro 1 billion.

Besides, a Green Corridors-II for solar parks is also started which is connecting 34 solar parks in 21 states of 20 GW capacity including Andhra Pradesh, Madhya Pradesh, Karnataka, Rajasthan and Gujarat.

The first phase of the program is designed to support 33 GW of solar and wind power, while the second phase will link 22 GW capacity and both phases are expected to be completed by 2019.

Poor Financial Health of Utilities

Over 40% of the wind power generating capacity are facing problems over payments and demand. This is because Distribution Companies (Discoms) are predominantly State-owned and have been financially distressed for several years despite reforms in the power sector aimed at unbundling power generation, transmission and distribution activities. Discoms have been historically plagued by transmission and

distribution losses arising mainly from theft of electricity, subsidized tariff for agricultural consumption, leakages in transmission and distribution systems and aggregate technical and commercial losses primarily due to billing and collection inefficiencies.

In November 2015, Central Government launched the Ujwal Discom Assurance Yojana (“UDAY”), a scheme for the financial turnaround of Discoms by 2019 with an objective to improve the operation and financial efficiency of State owned Discoms. The UDAY scheme intends to achieve this through improving operational efficiencies, reducing the cost of power generation, financial turnaround of Discoms through State(s) takeover of Discoms debts, and financing future losses and working capital of Discoms by State(s). States accepting UDAY and performing as per operational milestones will be given additional / priority funding through central schemes of Ministry of Power and Ministry of New and Renewable Energy.

As on 20 November 2017, 27 States and 4 Union Territories have joined UDAY program covering 97% of total utilities’ debt. The scheme has a positive impact but its full effectiveness, if realised, should be visible in next couple of years.

Repowering and hybrid projects

In August 2016, MNRE released the policy for repowering of wind power projects in India. Most of the wind-turbines installed up to the year 2000 are of capacity below 500 kW and are at sites having high wind energy potential. As per MNRE, over 3000 MW capacity installation are from wind turbines of around 500 kW or below. Wind turbine generators of capacity 1 MW and below would be eligible for repowering and there will be an additional interest rate rebate of 0.25% over and above the interest rate rebates available to the new wind projects being financed by IREDA. All fiscal and financial benefits available to the new wind projects will also be available to the repowering project as per applicable conditions. It is expected that repowering will trigger the additional and cyclic wind power growth as initial batch of wind turbine installations are nearing their end of design life.

Similar to repowering policy, MNRE came up in June 2016 with a draft National Wind-Solar Hybrid policy to seek suggestions of the stakeholders. The draft policy has set a goal of 10 GW for wind-solar hybrid by 2022.

Offshore Wind

India is blessed with long coastline of 7516 km and an exclusive economic zone of about 2 million sq. km where India has a right in relation to activities such as production of energy from wind. There has been several attempts in the past to broadly assess the potential of offshore wind. NIWE measured wind data from 74 met masts from different coastal locations and the preliminary studies undertaken by NIWE indicate that the coastal line of Gujarat and Southern part of Tamil Nadu have good wind potential especially in Rameshwaram and Kanyakumari regions with a possibility of developing 1 GW each at both locations.

To further validate the finding, NIWE commissioned 100m met mast in Dhanushkodi, Rameshwaram region and analysed the data recorded between October 2013 and September 2014. As per NIWE, the preliminary energy analysis indicates a good possibility of achieving more than 45% Capacity Utilisation Factor with the current onshore wind turbine technology in the Dhanushkodi arrow like strip region.

In addition to above studies, a project named Facilitating Offshore Wind in India (FOWIND), primarily funded by European Union, is being carried out by a consortium led by Global Wind Energy Council (GWEC). DNV GL, technical partner in the consortium, undertook the meso-scale modelling of the regions encompassing Gujarat and Tamil Nadu’s coastal water within the exclusive economic zone which is 200 nautical miles from the baseline. As a part of the studies, FOWIND has come up with potential 8 offshore zones with total offshore potential in the range of 100 GW each in Gujarat and Tamil Nadu. FOWIND has recently commissioned India’s first offshore LiDAR, off the coast of Gujarat, in the Gulf of Khambhat to collect the wind data.

First Offshore Wind Project of India (FOWPI) is another project funded by European Union and it aims to provide technical assistance in preliminary implementation of first off-shore wind farm project of India, on a sea bed area of 70 sq. km. with a tentative capacity sizing of 200MW near the Gulf of Khambat, approximately 25km off the shore of Gujarat.

The various studies so far undertaken has indicated the technical possibility of offshore project in India and Government has confirmed its intention by releasing the National Offshore Wind Energy Policy in October 2015. As per the policy, MNRE will act as the Nodal Ministry for development of offshore wind power and NIWE will act as the Nodal Agency for exploration and exploitation of offshore wind power in the exclusive economic zone which is 200 nautical miles from the baseline. Though policy doesn’t spell out any financial incentives but allocates the responsibilities among the various govt agencies and provides a high-level guidelines towards realisation of offshore project. Early 2017, Government has also come up with draft guidelines for offshore studies and surveys by private sector.

Policy changes and current challenges

Both AD and GBI scheme for wind energy ended on 31 March 2017 and Industry fiercely advocated for its extension arguing that such incentives would be further required if India should achieve the high target goal of 175 GW by 2022. However, this is infructuous now given that Government has moved to reverse auction model for wind extending the experience of its solar reverse bidding. This model has discovered the unit price incredibly as low as 2.44 INR for solar and 2.64 INR (against the typical tariff price of more than 4.0 INR) for wind. The reverse auction is meant to create a level playing field and unlock the full potential by encouraging innovation and competition. No doubt, reverse bidding mechanism reflects the maturity and confidence in the market by the Government where renewable is competing with other conventional sources but it should also be noted that three previous attempts to hold such auction -one by the Karnataka government, followed by two such by the Rajasthan government -failed as several legal issues were raised and this time too auctions are being postponed due to such issues. Its adverse impact is clearly felt as only 421 MW of wind was installed between April and September this year as against 1,305 MW installed during the same period last year. Due to the lower price discovery, it was reported that few State utilities showed reluctance to sign new power purchase agreement or honour existing one which were at the higher price and this clearly sent a wrong signal to the existing and potential investors.

There is no short and mid-term schedule defined for auction and hence there seems to be a rush in winning the bid which is less convincing in terms of its financial viability. It will be keenly watched if all the winning auctions are implemented within the time.

Conclusion

Indian Government has had a focus on renewables from the beginning and this was quite evident as India was probably the first Country in the World to set up a ministry for non-conventional sources in the early 1980s. Since then, all Governments have supported the development though wind industry had its own ups and downs during the journey of more than two decades. The current government at the centre has a special focus given its commitment for the remarkably high target of 175 GW by 2022 and its commitment under Paris agreement.

Government’s intention is duly backed by the fact that India has around 300GW of wind potential out of which only 32GW has been so far harnessed. Repowering, hybrid and offshore are other avenues that provide assurance for the long term viability of the market. Government also appears to be keen and working in removing the major hurdles like inadequate grid infrastructure and poor financial health of the utilities. All these augers well for the long-term future of wind industry in India. However, the recent reverse auction model has created a major disruption which could lead to restructuring in the market and smaller players may get marginalised. So far India has had a structured and stable wind energy growth and reverse bidding could take it to the next level of growth but Government should immediately iron out the hurdles to maintain the continuity and momentum in the business.

Annual calendar for the auction for long term planning and ground work, strict implementation of Renewable Purchase Obligation, assurance of project quality and monitoring mechanism to ensure its timely completion of projects are few steps in right direction which would go a long way in ensuring another round of structured and stable development of wind power in India.