Carbon Credits: Paving the Path for India’s Sustainable Future

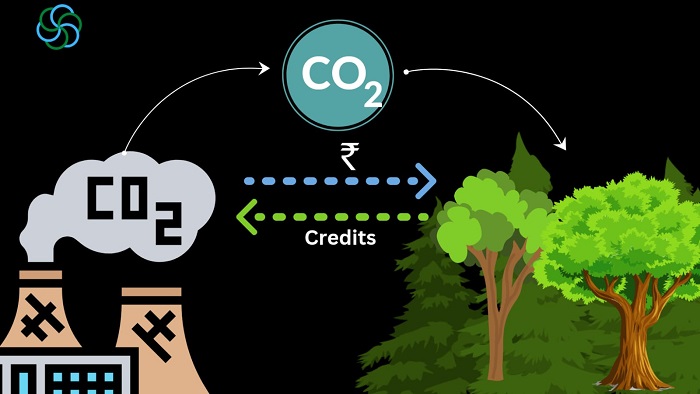

In an era of growing environmental concerns and the pressing need to curb greenhouse gas emissions, carbon credits have emerged as a market-based approach to tackling climate change. Carbon credits represent a permit that allows an entity to emit one ton of carbon dioxide equivalent (CO2e) or an equivalent amount of other greenhouse gasses. These credits can be traded among entities, providing an incentive for companies and individuals to reduce their emissions.

India, as a rapidly developing nation with a growing economy, is also facing the challenge of reducing its carbon footprint. In line with its international commitments under the Paris Agreement, India has set ambitious climate goals, including a target of achieving net-zero emissions by 2070. Carbon credits are considered a crucial tool in India’s strategy to achieve these goals.

What is a Carbon Credit?

A carbon credit is a tradable certificate or permit that represents the right to emit one ton of carbon dioxide equivalent (CO2e) or an equivalent amount of other greenhouse gases. Carbon credits are created when an entity reduces or avoids emissions below a specific cap or baseline. These credits can then be sold to other entities that need to meet their own emissions reduction targets.

How Carbon Credits Work

The carbon credit market operates on a cap-and-trade system. Under this system, a total cap is set on the amount of greenhouse gases that can be emitted by a particular sector or group of entities. Each entity is then allocated a certain number of carbon credits, which represent their permitted emissions. If an entity reduces its emissions below its allocation, it can generate surplus carbon credits, which it can then sell to other entities that need to meet their emissions targets.

Carbon credits can be traded on both regulated and voluntary carbon markets. Regulated carbon markets, such as the European Union Emissions Trading System (EU ETS), are established by governments and have legally binding emissions targets. Voluntary carbon markets, on the other hand, are not subject to government regulation and are driven by private demand for carbon offsets.

Carbon Credit Policy in India

India’s carbon credit policy is still in the early stages of development. In 2022, the Indian government passed the Energy Conservation (Amendment) Act, which empowers the central government to establish a domestic carbon credit trading scheme. The scheme is expected to be launched in the near future.

The proposed carbon credit trading scheme in India will initially be limited to energy-intensive industries, such as power, cement, and steel. These industries are responsible for a significant share of India’s greenhouse gas emissions.

ALSO READ: Tackling India’s Waste Problem: A Looming Environmental Crisis

The Indian government has also introduced the Green Credits Programme, which is a voluntary carbon offset scheme. Under this scheme, entities can earn carbon credits by undertaking activities that reduce or avoid greenhouse gas emissions, such as planting trees, conserving water, and promoting sustainable agriculture.

Benefits of Carbon Credits

Carbon credits offer several potential benefits, including:

- Promoting cleaner technologies: Carbon credits can incentivize companies to invest in cleaner technologies and processes that reduce their emissions.

- Enhancing resource efficiency: Carbon credits can drive companies to adopt more efficient practices, such as energy conservation and waste reduction, which can also lead to cost savings.

- Supporting sustainable development: Carbon credits can generate revenue for project developers and communities in developing countries, which can be used to fund sustainable development projects.

Challenges of Carbon Credits

Carbon credits also face some challenges, including:

- Setting appropriate emissions caps: It is important to set emissions caps at a level that is ambitious but achievable. If the caps are too high, it will not be effective in reducing emissions. If the caps are too low, it could lead to economic hardship.

- Ensuring additionality: It is important to ensure that carbon credits represent real and additional emissions reductions. This means that the emissions reductions would not have occurred without the carbon credit market.

- Preventing double counting: It is important to prevent double counting of emissions reductions. This means that an emissions reduction should not be credited to more than one entity.

India’s Role in the Global Carbon Credit Market

India is expected to play a significant role in the global carbon credit market. The country has a large and growing economy, and it is also home to a significant potential for emissions reductions. As India implements its carbon credit policy, it could become a major source of carbon credits for the global market.

ALSO READ: Air Purifiers vs Humidifiers: Which is Best for You?

Carbon credits have the potential to play a crucial role in India’s efforts to reduce greenhouse gas emissions and achieve its climate goals. The Indian government’s carbon credit policy is still in development, but it is a promising step in the right direction. With careful implementation, carbon credits can help India transition to a low-carbon economy and contribute to the global fight against climate change.