New report highlights the need for a phased, inclusive, and transparent carbon market design to accelerate India’s climate goals while maintaining economic growth.

Eversource Capital, the sustainable and climate investment fund focused on a single country in the Global South, in collaboration with CRISIL, has released a report titled “Building a Global Carbon Market: Accelerating India’s Progress Towards Net Zero.”

The report was officially unveiled by Yogieta Mehra, Joint Secretary, Central Electricity Regulatory Commission, at a high-profile event attended by over 50 industry leaders, policymakers, and climate experts.

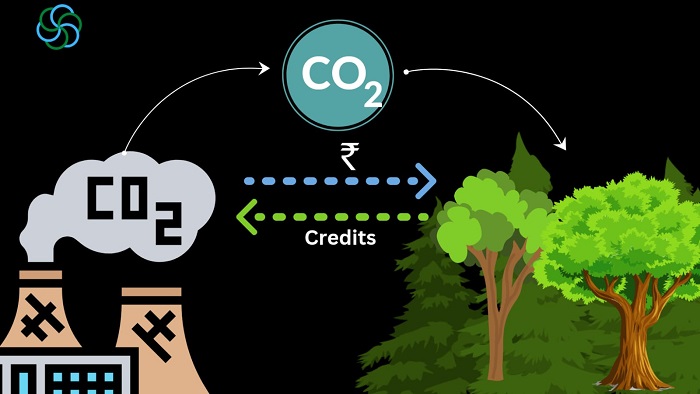

The report underscores the growing importance of carbon markets in harmonizing emission reductions with economic growth. It emphasizes that India, with its distinct socio-economic challenges, requires a phased, transparent, and inclusive carbon market structure tailored to its unique context.

Strategic Vision for India’s Carbon Market

According to Dhanpal Jhaveri, CEO of Eversource Capital, “A well-structured carbon market can be a game-changer for India, allowing climate goals to progress hand-in-hand with economic development. Emissions intensity-based targets offer a realistic and scalable starting point for market evolution.”

The report advocates for starting with emissions intensity targets, enabling India to manage low-carbon growth without sacrificing competitiveness. Over time, this can transition to absolute emission caps—paving the way for robust carbon pricing and unlocking investments in clean energy, especially in hard-to-abate sectors.

Key Recommendations for India’s Carbon Market Framework

The report outlines critical features for an effective Indian Carbon Market (ICM), including:

- Technology Enablement: Enhancing Measurement, Reporting, and Verification (MRV) systems to improve transparency and ease participation.

- Market Infrastructure: Developing robust mechanisms for efficient carbon credit trading.

- Demand-Supply Balance: Introducing credits via pilot entities and allowing flexibility in compliance through offset markets.

- Scope and Coverage: Gradually expanding market participation across sectors and pollutants.

- Cap and Credit Allocation: Implementing stricter emission targets as the market matures.

- Revenue and Penalty Utilization: Enforcing penalties and channeling proceeds into renewable energy initiatives.

India’s commitment to achieve net zero emissions by 2070 is closely tied to the development of a dynamic carbon market. The report emphasizes the need for carbon pricing mechanisms that exceed marginal abatement costs to encourage investments in sustainable technologies and foster innovation.

“We are excited to launch a report that lays the foundation for a scalable and globally aligned carbon market in India,” said Pranav Master, Senior Practice Leader and Director at CRISIL Intelligence. “Our objective is to catalyze collaboration and elevate India’s position as a frontrunner in the global carbon economy.”